Your Customer Acquisition Cost Calculator

Stop guessing your marketing ROI. Build and use a customer acquisition cost calculator with our guide, template, and real-world business examples.A proper Customer Acquisition Cost (CAC) calculation has to go way beyond what you're spending on ads. To get a number you can actually trust, you need to add up your total sales and marketing expenses—we’re talking salaries, software, agency retainers, the whole lot—and divide that by the number of new customers you brought in over a specific period. Anything less is just guessing.

Why Those Generic CAC Calculators Are So Misleading

Let's be real for a second. The free, plug-and-play calculators you find online often give you a dangerously incomplete picture of your business's health. They strip the formula down to just marketing spend because it's easy, but that simplicity can fool you into thinking your acquisition efforts are way more profitable than they are.

This simplified view creates a false sense of security. For example, a SaaS company might spend $5,000 on Google Ads and get 50 new customers, leading them to believe their CAC is a healthy $100. However, they're ignoring the $8,000 salary for the marketing manager running the ads and the $1,000 for their CRM. The true cost is actually $280 per customer—a number that could be completely unsustainable.

The Hidden Costs That Secretly Inflate Your CAC

The real price tag for a new customer is buried in expenses that go far beyond your ad budget. A truly accurate customer acquisition cost calculator must account for every related cost. Forgetting these is how you end up with flawed marketing strategies and growth that just isn't sustainable.

Most businesses I've seen stumble by missing the same key expenses. They're often hiding in plain sight.

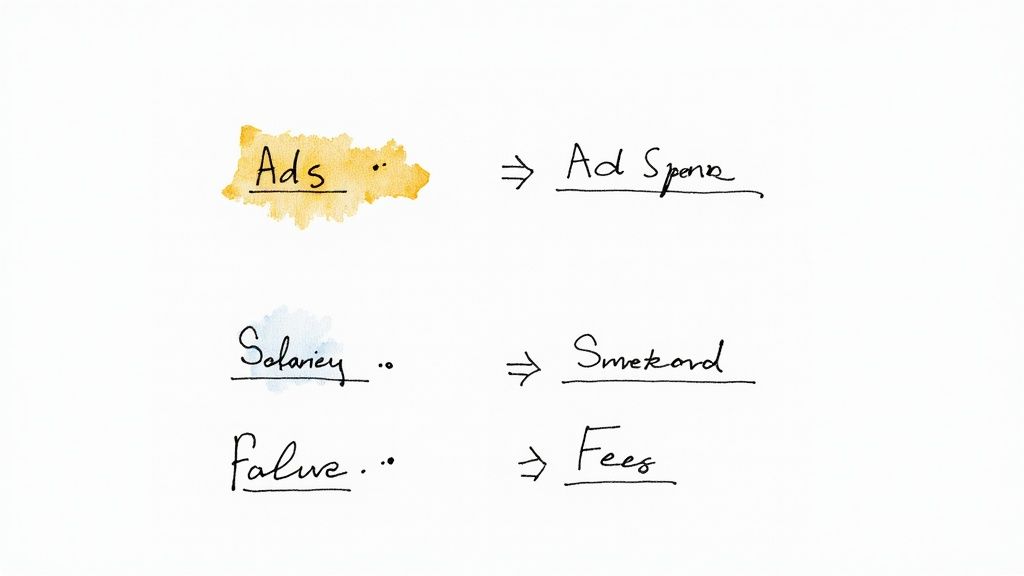

Here's a quick look at the standard inputs versus the comprehensive ones you actually need for an accurate CAC calculation.

Essential Costs Often Missing from Your CAC

| Cost Category | Commonly Overlooked Examples | Why It's Critical to Include |

|---|---|---|

| People Costs | Salaries, commissions, and bonuses for your marketing and sales teams. | This is often your single largest acquisition expense and can easily double your perceived CAC. |

| Tech Stack | CRM (HubSpot, etc.), marketing automation, analytics tools, SEO software. | These tools are the engine of your acquisition efforts; their subscription fees are a direct cost. |

| Content & Creative | Fees for freelance writers, graphic designers, video editors, or production costs. | Great content isn't free. The cost to create the assets that attract customers belongs in your CAC. |

| External Partners | Retainers for marketing agencies, PR firms, or sales consultants. | If you're paying someone else to help you acquire customers, that's part of the cost. |

Neglecting these "hidden" costs means you're operating with a skewed metric. You can't optimize what you don't accurately measure, and a flawed CAC number will always point your strategy in the wrong direction.

The Rising Price of Acquiring New Customers

Getting your CAC right has never been more critical, because it's only getting more expensive to win new business. Over the last decade, the average cost to acquire a customer has exploded by a staggering 222%. It shot up from just $9 back in 2013 to a projected $29 by 2025.

This spike is fueled by more expensive digital ads and cutthroat competition in almost every industry. It makes an accurate customer acquisition cost calculator a non-negotiable tool for survival. If you're interested in the data behind this trend, you can learn more about the escalating cost of customer acquisition.

The goal here isn't just to find a simple calculator. It's to understand why building a custom, comprehensive one is absolutely vital for your financial planning and long-term success.

Getting the Right Financial Data

To get a real, honest Customer Acquisition Cost, you have to start with the right numbers. I've seen countless companies get this wrong by only looking at their ad spend, which leads to a dangerously incomplete picture. The old saying "garbage in, garbage out" is especially true here; your CAC is only as reliable as the data you put into it.

Think of yourself as a detective for a moment. Your mission is to track down every single dollar spent on sales and marketing over a specific time, say, the last quarter. This means digging into more than just one platform.

Sourcing Your Core Expenses

Let's start with the easy stuff—the direct costs. These are the expenses that are front and center, but they're just the tip of the iceberg.

- Marketing & Advertising Spend: This is the most obvious one. You'll want to pull the total spend from your ad platforms like Google Ads, Facebook Ads, or LinkedIn Campaign Manager. Actionable step: Export a report from each platform for Q1 (Jan 1 - Mar 31).

- Team Salaries & Commissions: People are your biggest investment and a huge part of your acquisition cost. Head over to your accounting software—like QuickBooks or Xero—and find the gross salaries and any commissions paid to your entire sales and marketing crew.

- Software & Tool Subscriptions: Don't forget the tech that keeps the engine running. Scan your expense reports for all those monthly and annual subscriptions for your CRM, email marketing tools, and any analytics software. Actionable step: Search your company credit card statements for recurring charges from vendors like HubSpot, Mailchimp, or SEMrush.

This process involves pulling information from a few different places, as you can see here.

The key takeaway is that you can't just live in your ad dashboard. A true CAC calculation pulls together data from multiple business systems to see the complete picture.

One of the most common mistakes I see is stopping at these direct costs. If you do that, you're not getting a real CAC. You absolutely have to include the indirect expenses that support your entire acquisition machine.

This could be anything from fees you pay to freelance writers and designers to a portion of the office rent allocated to the sales and marketing teams. It even includes project-specific costs; for instance, understanding the full mobile app development cost often means factoring in the initial user acquisition marketing budget.

My advice? Get all these numbers organized in a simple spreadsheet first. It'll make the actual calculation a whole lot easier.

Building Your Calculator in a Spreadsheet

The screenshot above gives you a great visual for a clean, organized customer acquisition cost calculator built right in Google Sheets. I love this approach because it forces you to itemize every single marketing and sales expense. You can see exactly where your budget is going before it all gets lumped into one big number, which is essential for spotting rising costs and finding ways to spend smarter.

You really don't need expensive, specialized software to get a firm grip on your CAC. In my experience, a simple spreadsheet in Google Sheets or Excel is one of the most powerful and flexible tools for the job. It puts you in the driver's seat, letting you customize every detail to match how your business actually operates.

The key is to create a living document—something you can update monthly or quarterly to see how you're trending. You'll start by listing out every single cost related to sales and marketing, each in its own row.

Setting Up Your Cost Categories

When it comes to listing expenses, be exhaustive. Think of everything. Breaking your costs down into clear, logical groups is the foundation of an accurate customer acquisition cost calculator. If you miss something here, your final number will be off.

Here’s a practical way I like to organize the rows:

- Advertising Spend: Give each platform its own line—Google Ads, Facebook Ads, LinkedIn Ads, you name it.

- Team Costs: This is a big one. You'll need rows for Marketing Salaries, Sales Salaries, and any Commissions paid out.

- Software Subscriptions: List your CRM, email marketing platform (like Mailchimp or Klaviyo), analytics tools, and anything else you pay for monthly or annually.

- Content & Creative: Don't forget to add lines for freelance writers, agency retainers, or any video production costs.

Once you have your costs listed down the side, create columns for each month or quarter across the top. This structure makes it incredibly easy to plug in your expenses for a given period and instantly see how your CAC is changing over time.

Pro Tip: I always add a row at the very bottom labeled "New Customers Acquired." This is the other half of your CAC formula, and it's just as important as the costs. Tracking it right next to your spending gives you immediate, powerful context.

The Formula and Your Template

With all your data neatly organized, the final piece is the calculation itself. It's surprisingly simple. In a new cell at the bottom, just use the SUM function to add up all your costs for that period. Then, you'll divide that grand total by the number of new customers you brought in.

In a spreadsheet, the formula will look something like this:

=SUM(B2:B15)/B16

(This assumes your costs are listed in cells B2 through B15 and your new customer count is in cell B16).

Practical example: If your total costs in column B sum to $30,000 and you acquired 100 new customers (cell B16), your CAC for that period is $300.

If you want to skip the setup, you can always grab a pre-built Google Sheets template and just drop your own numbers in. It saves a ton of time and helps ensure you don’t overlook any critical cost centers.

And remember, tracking CAC is just one piece of the puzzle. For businesses looking to really optimize their funnel, a detailed UX design audit can uncover friction points on your website that hurt conversion rates. Fixing those issues is a fantastic way to lower your acquisition costs without even touching your ad spend.

Turning Your CAC Into Strategic Decisions

https://www.youtube.com/embed/jkBE5K6Vtcg

Having a number spit out by your customer acquisition cost calculator is a great starting point, but that number is pretty useless on its own. The real magic happens when you put it into context to actually guide your business strategy. Think of your CAC as one half of a critical equation—an equation that reveals the true health of your business model.

The other half? That’s your Customer Lifetime Value (LTV). This is your best estimate of the total revenue a single customer will bring in over their entire relationship with your company. When you compare your LTV to your CAC, you can finally answer the most important question of all: is your growth actually profitable?

The LTV to CAC Ratio Explained

This comparison gives you the LTV to CAC ratio, which is arguably the single most important metric for any growing business. It’s a direct measure of the return you’re getting on every dollar spent to win a new customer. While the ideal number can shift a bit depending on your industry, a healthy benchmark to shoot for is 3:1.

- 1:1 Ratio (Danger Zone): This is a red flag. It means you’re spending exactly as much to get a customer as they will ever give you back. Your business model is on thin ice and won't survive long-term.

- 3:1 Ratio (Healthy & Sustainable): This is the sweet spot. For every dollar you put into acquisition, you’re getting three dollars back over time. This shows you have a profitable and a scalable business model.

- 5:1+ Ratio (Aggressive Growth): Your marketing is firing on all cylinders. A ratio this high might be a signal to double down and invest more heavily in your winning channels to grab more market share before competitors catch on.

A low CAC isn't automatically a good thing. If your CAC is incredibly low but your growth has flatlined, it could mean you're not investing enough in marketing. You might be leaving a huge amount of market share on the table for someone else to take.

Diagnosing Your Results in the Real World

Context is everything. A "good" CAC is always relative, and you have to account for real-world variables. For example, acquisition costs can vary wildly by region. North America often has the highest average cost-per-install (CPI) at $5.28, which is way more than in EMEA ($1.03) or APAC ($0.93). These differences are driven by things like market saturation and advertising competition, which you can read more about in these global acquisition cost statistics.

Actionable Insight: If your company sells a subscription box for $40/month with an average customer lifespan of 12 months, your LTV is $480. If your CAC is $150, your LTV:CAC ratio is 3.2:1—a very healthy sign. But if your CAC creeps up to $250, your ratio drops to 1.9:1, signaling it's time to optimize your spending or improve retention.

Remember, a high CAC isn't a crisis if your LTV is even higher. On the flip side, a low CAC means nothing if you’re acquiring customers who churn after a month. Use the output from your calculator to start asking smarter questions and drive real, strategic change in your business.

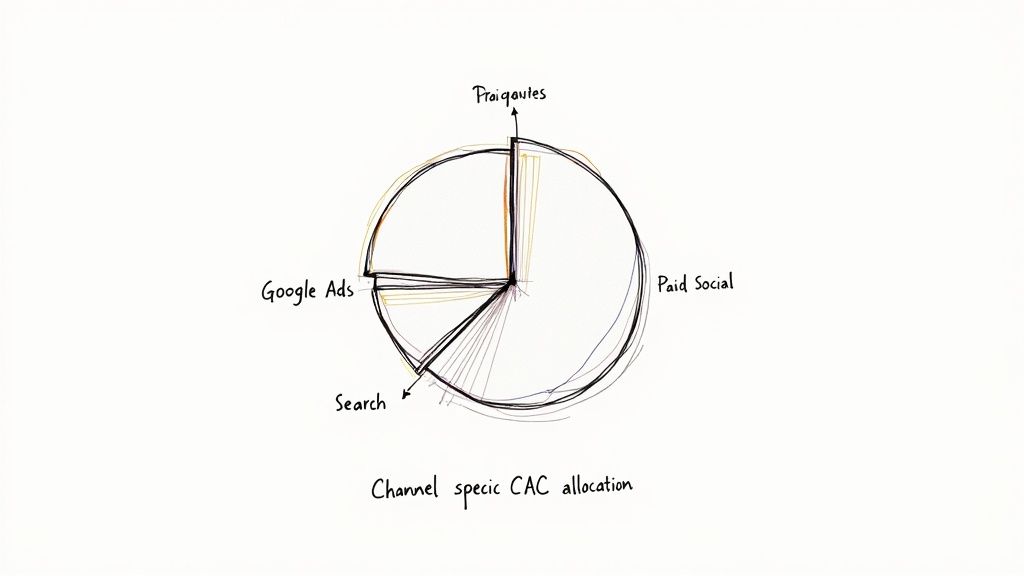

How to Calculate CAC by Marketing Channel

While a blended CAC gives you a nice 30,000-foot view, the real magic happens when you break it down by channel. This is where you uncover which of your marketing efforts are actually making you money and which are just draining your budget. It's this level of detail that lets you start making smarter decisions to lower your overall acquisition cost.

So, how do you upgrade your customer acquisition cost calculator to do this? It's pretty simple, actually. You run the same basic formula—total costs divided by new customers—but you isolate the data for each individual channel.

For channels with direct costs, like Google Ads or paid social, the math is a piece of cake. Just take your total ad spend for that platform and divide it by the customers it brought in. The real challenge is figuring out how to handle the shared, indirect costs like salaries and software.

Allocating Shared Costs Fairly

To get a truly accurate channel CAC, you have to divvy up those shared expenses—like your team's salaries and tool subscriptions—across the channels they support. One of the most practical ways to do this is with a percentage-based model reflecting where your team invests its time and effort.

Let's imagine you have a content marketer on your team. You could allocate their salary based on how they split their work:

- 70% to Organic Search: For all the time they sink into SEO, keyword research, and writing blog posts.

- 30% to Social Media: To account for creating social content and managing the community.

If their monthly salary is $5,000, you’d add $3,500 to the cost bucket for your Organic Search channel and $1,500 to Social Media before calculating the final CAC for each. This way, your "free" channels, like organic search, start to show their true cost.

This granular view is what separates good marketing from great marketing. It gives you the confidence to double down on what works, slash what doesn't, and build a much more efficient and profitable acquisition machine.

This approach also helps you appreciate the full customer journey. A fantastic blog post might get someone in the door, but a smooth signup flow is what actually converts them. Nailing that initial user experience with effective product-led onboarding can lift conversion rates across every single one of your channels.

Common Questions About Calculating CAC

Even with a great customer acquisition cost calculator in hand, you'll still run into some practical questions. Getting the right answers here is what separates a vanity metric from a truly strategic tool that can shape your business.

Let’s dig into the questions I hear most often.

What Defines a Good Customer Acquisition Cost?

There's no magic number. A $500 CAC might be a fantastic deal for a B2B SaaS company with enterprise clients, but it would be a death sentence for a mobile app charging $5 a month.

The only real way to know if your CAC is "good" is to stack it up against your Customer Lifetime Value (LTV).

The LTV to CAC ratio is what matters. A healthy, sustainable business model usually sits around a 3:1 ratio. In other words, for every dollar you put into getting a new customer, you should be getting at least three dollars back over their lifetime with you. A 1:1 ratio isn't a business; it's a very expensive hobby.

How Often Should I Calculate My CAC?

For most companies, running the numbers monthly and quarterly strikes the perfect balance.

Monthly tracking gives you a tactical view. For example, if you see your CAC spike in March, you can investigate immediately. Did a specific ad campaign underperform? Did a competitor start a price war? This allows for quick, corrective action.

Quarterly reports offer a more strategic, big-picture perspective. Looking at a three-month window smooths out the inevitable peaks and valleys, giving you a much more reliable foundation for high-level planning and budgeting.

Trying to calculate CAC daily is almost always a mistake. Customer conversion cycles have a natural lag, and daily numbers will just send you on a rollercoaster of bad data and knee-jerk reactions.

The single biggest mistake I see is teams only including their ad spend. Forgetting salaries, commissions, agency retainers, and software fees gives you a dangerously optimistic CAC and leads to terrible budget decisions.

An accurate CAC has to account for all sales and marketing expenses to be useful. If you're launching something new, figuring out how to bring a product to market successfully relies on having this kind of financial clarity right from the start.

At Pixel One, we transform complex challenges into simple, scalable digital products. If you're ready to build a product with a clear path to profitability, let's connect.